Financial management is the process of planning, organizing, and controlling your money. It can be a daunting task, but it's essential for achieving your financial goals.

In this blog post, we'll provide you with the ultimate guide to financial management. We'll cover everything from budgeting and saving to investing and debt repayment. And we'll show you how Payscribe can help you achieve your financial goals.

Budgeting

Budgeting is the foundation of financial management. It's simply a plan for how you're going to spend your money. A good budget will help you track your spending, save money, and reach your financial goals.

There are many different budgeting methods out there. The best method for you will depend on your individual circumstances and needs. But some popular budgeting methods include:

- The 50/30/20 rule: This rule divides your income into three categories: needs, wants, and savings. 50% of your income goes towards needs, 30% goes towards wants, and 20% goes towards savings.

- The envelope system: This method involves physically dividing your cash into envelopes, each labeled for a different category of spending. This can help you stay on track with your budget.

- Online budgeting tools: Payscribe provides you an easy to use budgeting tool that can help you track your spending and create a budget.

Saving

Saving money is essential for financial security. It can help you cover unexpected expenses, save for a down payment on a house, or retire comfortably.

There are many different ways to save money. Some popular methods include:

- Setting up a savings account: A savings account is a safe place to store your money and earn interest. With Payscribe, you can set this up in less than 2 minutes, with interest up-to 15%

- Automating your savings: You can automate your savings by setting up a direct deposit from your paycheck into your savings account. One of what we are pride of at Payscribe is the automation of savings ( daily, weekly, monthly) you can easily set automation time

- Using Payscribe savings goal app

Investing

Investing is a great way to grow your money over time. When you invest, you're essentially buying a piece of a company. As the company grows, the value of your investment will grow as well.

There are many different ways to invest. Some popular methods include:

- Investing in stocks: Stocks are shares of ownership in a company. When you buy stocks, you're essentially buying a piece of the company.

- Investing in bonds:Bonds are loans that you make to a company or government. When you buy bonds, you're essentially lending money to the company or government.

- Investing in mutual funds: Mutual funds are baskets of stocks or bonds that are managed by a professional. This can be a good way to invest if you don't have a lot of time or experience.

Debt repayment

Debt can be a major financial burden. But it's important to remember that you can get out of debt. There are many different debt repayment methods available. The best method for you will depend on your individual circumstances and needs.

Some popular debt repayment methods include:

- The debt snowball method: This method involves paying off your smallest debts first, regardless of the interest rate. This can help you build momentum and stay motivated.

- The debt avalanche method: This method involves paying off your debts with the highest interest rates first. This can save you money in the long run.

- Debt consolidation: This method involves consolidating all of your debts into one loan with a lower interest rate. This can make it easier to manage your debt and save money on interest.

Payscribe

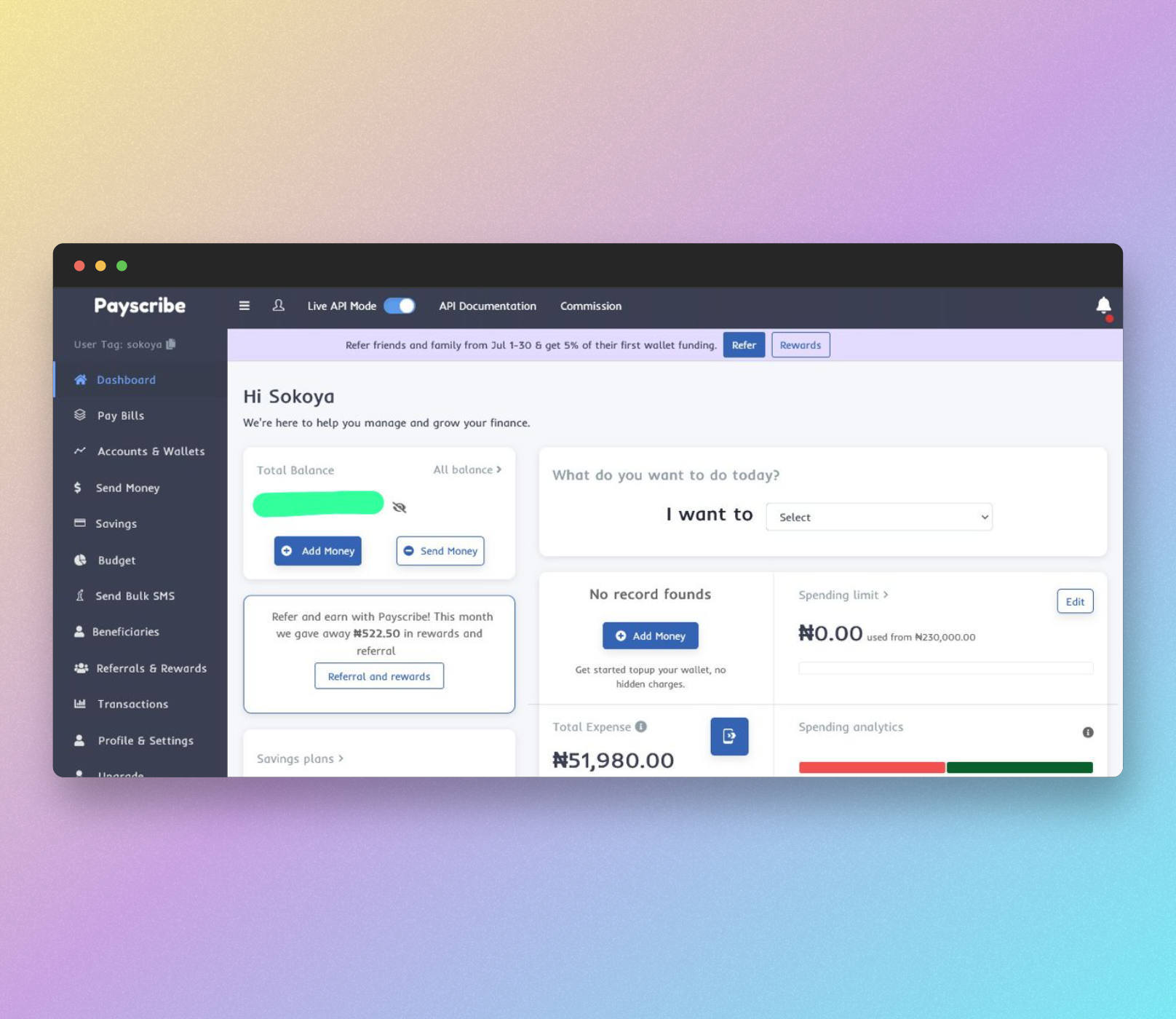

Payscribe is a financial management app that can help you achieve your financial goals. Payscribe offers a variety of features, including:

- Budgeting: Payscribe can help you create a budget and track your spending.

- Saving: Payscribe can help you set savings goals and track your progress. Create a target, fixed savings or Spend and save up-to 15% interest P.A. You can withdraw money any day, any time.

Conclusion

Financial management is an essential skill for anyone who wants to achieve their financial goals. By following the tips in this blog post, you can take control of your finances and reach your goals.

And with Payscribe, you can make financial management even easier. Payscribe is a powerful financial management app that can help you track your spending, save money, invest your money. From your Payscribe account, you can also send money to your loved ones, locally and globally (including GBP, USD, CAD and lots more) at an affordable rate, pay bills (top up airtime, internet data, daily essential payment) and get amazing cashback.

So what are you waiting for? Start using Payscribe today and take control of your finances.